2024 Seed Grant Program Awards Announced

Twelve research projects have been selected for funding through the Energy Institute's 2024 Strategic Energy Seed Grant Program. Key research areas include battery production, carbon capture, clean hydrogen, produced water treatment, and industrial decarbonization. The program is made possible with funding by corporate partners Bidra, Chevron, ConocoPhillips, ExxonMobil, Shell and SLB.

DOE Selects HyVelocity Hub for Historic Investment

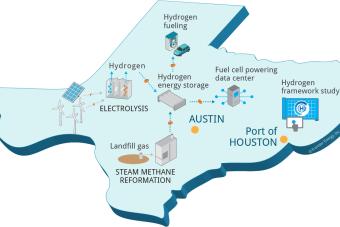

The Department of Energy (DOE) has announced that the HyVelocity Hub will be one of seven U.S. regional hubs to receive funding to accelerate the commercial-scale deployment of low-cost, clean hydrogen. UT Austin is the lead academic institution for the effort, which represents a broad coalition of industry and community partners.

UT Research Team Exploring Geologic Hydrogen Recovery

Assistant Professor Wen Song and her research team in the UT Hildebrand Department of Petroleum and Geosystems Engineering have been awarded a major grant by the Department of Energy to develop a foam injection approach to extract geologic hydrogen.

What Starts Here Energizes the World

At The University of Texas at Austin, one of the world’s leading research institutions, the Energy Institute is the gateway to UT’s top scholars and experts working across the entire spectrum of energy. We facilitate interdisciplinary research and engagement to transform the future of energy worldwide.

UT Energy Week

Register now! UT Energy Week 2024 will be held March 25 – 29, 2024. Hosted by the UT Energy Institute and the Kay Bailey Hutchison Energy Center, UT Energy Week 2024 will include five days of panels, keynotes, and special events.

Hydrogen Resources and News

The Energy Institute is supporting the momentum behind hydrogen energy through research, partnerships, and education. Read more about the recent HyVelocity Hub announcement and stay up-to-date on hydrogen news at UT Austin.

Energy Education at The University of Texas at Austin

The Energy Institute works with schools and departments across campus to foster energy-related courses. The Institute manages the interdisciplinary Graduate Portfolio Program in Energy Studies; sponsors a weekly guest lecture series, the UT Energy Symposium; and hosts UT Energy Week, an annual gathering of energy experts.

Resources

UT Energy Bulletin

A monthly e-newsletter recap of all things energy on The University of Texas at Austin campus.

Find an Expert

Energy at UT has more than 300 energy experts contributing to world-class research.

Spotlight

UT Energy Week

UT Energy Week 2024 will be held March 25 – 29, 2024.

UT Energy Symposium

This weekly class and public lecture series on Tuesdays during the fall/spring semesters features energy sector leaders and experts.

What Can Biology and Ecology Teach Us About Energy and the Economy?

James H. Brown Distinguished Professor Emeritus, Department of Biology, University of New Mexico

Charles A. S. Hall Professor Emeritus, SUNY College of Environmental Science and Forestry

Tuesday, Apr. 9, 2024, 12:30 to 1:30 p.m.

Catch Up on Past UT Energy Symposiums

Visit the Energy Institute YouTube channel to watch UT Energy Symposiums from our twelve-year archive.

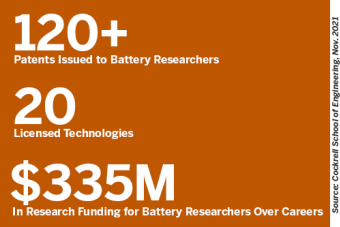

The Energy University Leads on Battery Innovation

The Cockrell School of Engineering has launched a new website for the UT Battery Research Group, which includes 28 faculty working on everything from novel storage materials to resource recovery.

New tool models future energy costs and carbon implications for U.S.

A new online interactive dashboard enables users to understand the costs and impacts of major supplies and demands of energy through the year 2050 across the U.S.

UT, Department of Energy, and partners launch hydrogen project

H2@Scale brings hydrogen industry leaders together in Texas to design, build, and operate the first dedicated renewable hydrogen network.

Thanks to our corporate partners for their generous support of UT's Energy Institute